There's a new gold rush sweeping the world - the gold price has now risen roughly 50 per cent over the year to date. Any asset reaching a record high is noteworthy, and there are a number of factors creating the recent price surge. But just because the gold price is soaring doesn’t necessarily make it a good investment. What are the pros and cons of investing in gold?

Gold has traditionally been seen as a hedge against inflation, to provide protection in a portfolio against equity market downturns, and an “asset of last resort”, because it can be a reliable store of value during economic instability, currency debasement, or geopolitical conflict. Unlike currencies or bonds, physical gold cannot be defaulted on and exists outside of government control, making it a stable and tangible safe haven when trust in institutions falters.

Over the last few years, many of these conditions have been in play – the sudden spike in inflation post the pandemic, conflicts in Ukraine and Gaza, economic uncertainty as long-established global trade norms unwind, and changes in politics and the world economy are starting to challenge the US Dollar’s dominance as the main global currency for reserves and trade.

However, some of these reasons for gold’s recent ascent seem weak when looked at through a longer time frame. In the case of inflation, as Tim Farrelly points out [1], when looking at rolling 1-year returns for gold (in USD) and US inflation over the last 40 years, the correlation has been close to zero. in other words, there is no relation between inflation and gold over one-year periods.

Gold has historically served as a financial refuge during times of geopolitical instability due to its intrinsic characteristics as a tangible asset with inherent value. However, it is difficult to gauge how recent localised conflicts in Ukraine and Gaza have contributed to gold’s rise, as equity markets have by and large ignored these conflicts. Even the price of oil, which one might expect to rise if the oil supply is compromised, has been falling over the last few years.

What does seem to be meaningfully contributing to the price of gold is the fact that Central Banks have been accumulating huge quantities of gold to diversify their foreign exchange reserves away from the US dollar, which has long held the title of the world’s reserve currency. The dollar's fall in value stems from concerns over the sustainability of US debt — that is, the ability of the US government to comfortably fund its spending.

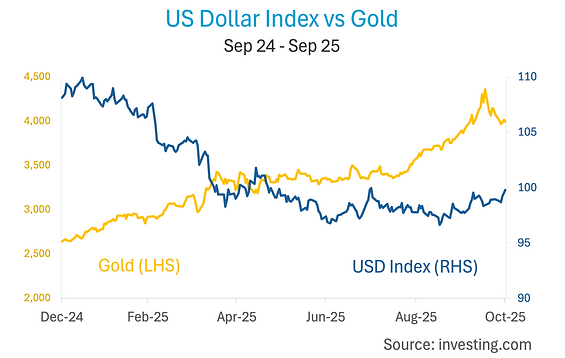

The chart below shows the decline of the US Dollar Index [2] (informally known as the Dixie) since the start of the year, and the corresponding rise in the price of gold (USD per ounce). Note the unexplained pullback in the price of gold on October 22nd, which brought an abrupt halt to the rapid advance over the year. Perhaps not surprising given the recent frenzy of mum and dads lining the street to buy gold bullion!

Central banks of countries that wish to remain non-aligned or independent of the US have become huge buyers of gold in recent years. Since February 2022, total reported central bank buying has increased fivefold [3]. Russia accelerated its gold purchases following its annexation of Crimea in 2014 and now has one of the largest stockpiles in the world. China has been selling down its holdings of US government bonds and switching to buying gold in a process referred to as “de-dollarisation”.

The chart below shows the increase in China’s gold stock registered "on warrant" — meaning formally recognised as available for exchange transactions – from 2010 to 2025. The increase in gold stock is most likely due to China's efforts to ease liquidity shortages in domestic markets and make gold more readily available as collateral.

An underlying driver that gets less attention is the effect that recent banking regulations have had. Basel III [4] effectively reclassifies physical gold as “cash-like” on bank balance sheets. This legitimises gold as a top-tier asset, which means banks can hold gold on their balance sheets without heavy capital penalties.

As the price of gold has increased due to these factors, it hasn’t gone unnoticed by investors, who now have much easier access to buying gold than in the past through gold exchange-traded funds (ETFs). Before the first gold ETF was launched in 2003, it was considered too difficult for regular investors to gain exposure to gold. Now gold ETFs are widely available, and gold can be traded like any other financial asset on the stock exchange, further driving the price of gold up.

Which brings us to the point where mum and dads are lining up in the streets to buy gold bullion… Does the current price make gold a good investment? What are the pros and cons of having gold in your portfolio?

Investing in gold offers both advantages and drawbacks. On the positive side, gold is known as a safe-haven asset, often retaining value during economic downturns and providing a hedge against market and currency fluctuations. It does add diversification to an investment portfolio, but whether it’s an effective diversifier is debatable. If gold is an insurance against equity downturns, then right now it is a very expensive insurance[5].

As an investment gold has limitations, the main one being that it generates no income like dividends or interest from bonds. Storage and insurance costs can further reduce returns, and its price can be volatile in the short term. It’s worth quoting Warren Buffett, who said back in 2009, “I have no views as to where gold will be (in the next five years), but the one thing I can tell you is it won’t do anything between now and then except look at you.”[6] That sentiment may well be true for the next five years.

Dr Steve Garth

November 17, 2025

[1] “What does the data say about gold as an inflation hedge?” Tim Farrelly LinkedIn post

[2] The US Dollar index is a measure of the value of the United States dollar relative to a basket of U.S. trade partners' currencies

[3] Central Bank Gold Buying Reaches Historic Highs https://discoveryalert.com.au/central-bank-gold-buying-surge-2025/

[4] Basel III is an international regulatory framework for banks that sets minimum standards for capital requirements, stress testing, and liquidity.

[5] “What does the data say about gold as a diversifier against equity risk?” Tim Farrelly LinkedIn post

[6] Warren Buffett, CNBC’s Squawk Box, 2009.